eBay Marketplaces plays a significant role in PayPal’s future growth, as the two companies have a long-standing partnership.

While eBay transitioned to a more independent payment processing system, PayPal continues to be a major player in facilitating transactions on the platform.

As eBay moves forward, the evolving dynamics of digital payments, global e-commerce, and consumer behavior will impact PayPal’s role.

By leveraging its integration with eBay and adapting to trends like mobile payments, AI-driven solutions, and cross-border commerce, PayPal has the potential to grow alongside eBay, reinforcing its position in the increasingly competitive payments market.

How core is eBay Marketplaces to PayPal’s future growth?

eBay Marketplaces was once a critical part of PayPal’s growth, but it is no longer central to PayPal’s future success. Since their 2015 separation, PayPal has expanded far beyond eBay, establishing itself as a dominant player in digital payments.

While eBay still accounts for some transaction volume, its significance has steadily declined as PayPal partners with major retailers, financial institutions, and tech companies.

PayPal’s growth now relies on areas like mobile payments, fintech, cryptocurrency, and business solutions rather than its former reliance on eBay transactions.

Additionally, eBay has been shifting towards its own payment system, reducing dependence on PayPal.

This move further highlights that PayPal’s future lies in a broader digital economy, serving millions of merchants and consumers worldwide. With strong investments in innovation, partnerships, and financial services, PayPal’s expansion beyond eBay ensures its continued growth and relevance in the evolving payments landscape.

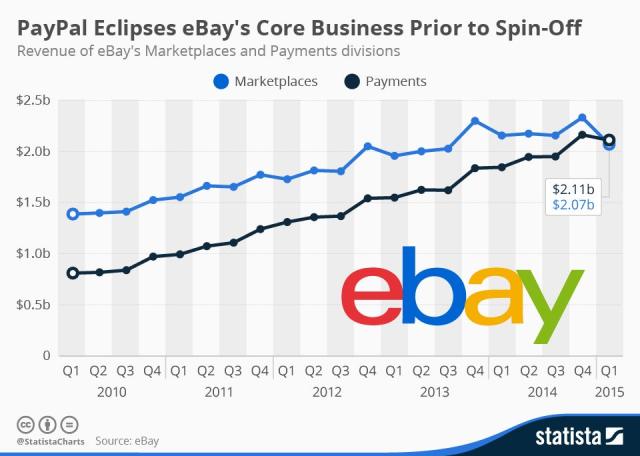

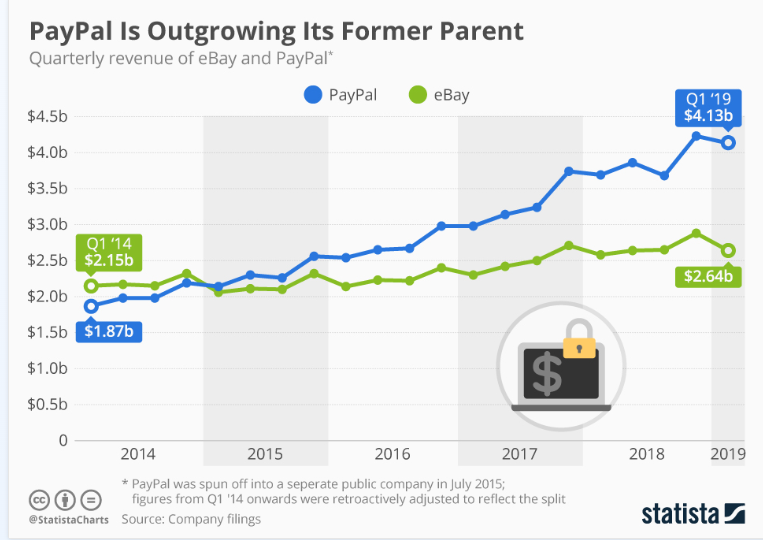

PayPal Is Pulling Away From Its Former Parent

The statistics show in the first quarter of 2019, eBay reported $2.6 billion in revenue, surpassing Wall Street expectations, while navigating the challenges following its split from PayPal in 2015.

Here, Is there a way to see when a listing was posted?

PayPal, on the other hand, showed impressive growth with over $160 billion in total payment volume and $4.1 billion in revenue, up 12% year-over-year.

The split was seen as beneficial for both companies, as PayPal’s growth accelerated while eBay struggled to keep up. Currently, PayPal’s market capitalization stands at $128 billion, nearly four times that of eBay’s $33 billion, indicating a continuing trend in their divergent paths.

9 Reasons why ebay marketplace is not so core for Paypal’s future growth

1. Separation of eBay and PayPal

In 2015, eBay and PayPal officially separated into two distinct entities, a move that marked a significant shift in their relationship. While PayPal continues to process payments on eBay, the breakup meant that the two companies no longer had the same direct dependencies on each other.

This separation allows PayPal to explore partnerships with other e-commerce giants, reducing its reliance on eBay’s marketplace. As a result, PayPal’s future growth is less dependent on eBay’s performance, and it can pursue broader opportunities in the global payments industry.

2. Diversification of PayPal’s Revenue Sources

PayPal has increasingly diversified its revenue streams, reducing its dependence on eBay’s marketplace. Beyond eBay, PayPal generates substantial income from services such as Venmo, PayPal Credit, and Braintree, as well as expanding its footprint in cryptocurrency transactions. The company has been growing its presence in mobile payments, peer-to-peer transfers, and e-commerce platforms like Shopify and Instagram.

This diversification means PayPal can thrive even without significant reliance on eBay’s marketplace, positioning itself for growth in various other sectors.

3. Competition from Other Payment Providers

While PayPal remains a dominant force in the digital payments industry, it faces increasing competition from other payment platforms such as Stripe, Square, and newer entrants like Apple Pay and Google Pay.

These competitors are rapidly gaining traction in e-commerce, mobile payments, and point-of-sale services. As these players expand their offerings, PayPal’s future growth will depend more on adapting to these competitive pressures and diversifying its ecosystem, rather than relying on a single marketplace like eBay.

4. Shift Toward Direct Payment Solutions

E-commerce platforms, including eBay, have been moving toward direct payment solutions instead of relying on third-party processors like PayPal. For instance, eBay implemented its own managed payments system, which allows the platform to handle transactions directly, reducing reliance on PayPal as the exclusive payment processor.

This shift enables eBay to retain more control over the payment process, offering better cost efficiencies and user experience. As eBay continues to reduce PayPal’s involvement, PayPal’s future growth must come from broadening its scope beyond eBay.

5. Global Expansion Beyond eBay’s Reach

PayPal’s growth strategy increasingly focuses on international markets, including emerging economies where eBay’s influence is limited. In regions like Asia, Africa, and South America, PayPal has been expanding its services to cater to the rising demand for digital payments and e-commerce solutions.

PayPal’s global expansion is not heavily tied to eBay’s marketplace, and the company’s ability to tap into new markets and form strategic partnerships with various financial institutions and e-commerce platforms ensures it can continue to grow independently of eBay.

6. Growth in Peer-to-Peer Payments

The rapid growth of peer-to-peer (P2P) payment systems like Venmo, which PayPal owns, has become a crucial driver of the company’s growth. Venmo, in particular, has become a popular platform for money transfers among individuals, especially in the United States.

The increasing popularity of P2P payments is shifting PayPal’s business model toward social and mobile payments, making eBay’s marketplace less significant to PayPal’s future success. Venmo’s integration with businesses and its future potential in digital wallets and other financial services further solidifies PayPal’s growing independence from eBay.

7. Focus on Financial Services and Lending

PayPal has been expanding into financial services, offering credit lines, working capital loans, and business financing options. This move is aimed at capturing a larger share of the financial services market, which is expected to experience significant growth in the coming years.

PayPal’s focus on lending, particularly through its PayPal Credit and working capital programs, enables it to diversify revenue streams and reduce its dependence on eBay’s marketplace. With financial services becoming a growing part of PayPal’s business, its future growth is increasingly aligned with the broader fintech ecosystem rather than eBay’s marketplace.

8. Technological Advancements in E-commerce

As the e-commerce landscape evolves, the integration of emerging technologies like artificial intelligence, blockchain, and the Internet of Things (IoT) plays an essential role in shaping the future of digital payments. PayPal is actively investing in these innovations to stay ahead of competitors and improve user experience across a variety of platforms.

The shift toward more advanced and autonomous payment technologies means that PayPal’s growth will be driven by technological advancements and partnerships with a wide array of global e-commerce platforms, not just eBay’s marketplace.

9. Strategic Partnerships Beyond eBay

PayPal’s growth strategy increasingly involves forming strategic partnerships with other companies and platforms outside of eBay. Collaborations with major retailers, financial institutions, and technology companies, as well as acquisitions of companies like Honey and iZettle, highlight PayPal’s broadening ecosystem.

These partnerships open up new avenues for PayPal to expand its services, including loyalty programs, mobile commerce, and cross-border payments. As PayPal’s network of partnerships grows, eBay’s marketplace becomes a less essential component of PayPal’s long-term growth strategy.

Top 10 Questions about the eBay-PayPal Separation

1. What is the strategic rationale for creating two independent businesses?

The Board believes that the long-term benefits of separation outweigh the benefits of staying together for three key reasons:

- Growth Opportunities: Separation positions eBay and PayPal to capitalize on their respective growth opportunities. Becoming independent in 2015 will provide each company with new market and partnership opportunities that would have been more difficult to pursue as a part of the combined entity.

- Competitive Edge: The global commerce and payments markets are rapidly changing, and each business faces different competitive opportunities and challenges. We can optimize the synergies with arm’s length operating agreements between the two entities, which can formalize the existing relationships between the two companies and help mitigate potential dis-synergies.

- Shareholder Value: The separation will offer shareholders the best path to sustainable shareholder value and will also create two distinct, attractive investment opportunities for eBay shareholders.

How to find listing start date for sold items on Ebay?

2. What has changed since the proxy contest when you said you were ‘Better Together?’

As we have said before, eBay’s Board of Directors regularly reviewed the company’s growth strategies and structures and assessed all alternatives. That’s why we said this was not a new idea. In the past, we concluded that separation was not the right decision. We also said we would keep an open mind.

However, as part of recent assessments, the board has explored separation, specifically whether it would:

- Make eBay and PayPal more competitive.

- Be possible without distracting innovation and execution.

- Create sustainable value for shareholders over time.

For more than a decade, the businesses have mutually benefited from being part of one company, and have served each other and shareholders well together. The growth of both businesses and shareholder value created demonstrate the decision to keep the businesses together to have been the right one. The board explored these three questions and concluded that this is the right time to separate the businesses.

3. How will you keep the synergies that have made the last decade successful?

We have done an extensive analysis and expect these synergies to become less important over time; we intend to structure arm’s length operating agreements that are intended to preserve the existing synergies between the two businesses.

We will in due course provide more information on the two companies and our plans for them to operate independently.

4. What new opportunities can the independent companies pursue that were not available to the combined company?

It is too early to get into the specifics here, and we expect the separation to take up to 12 months to finalize.

Here’s Is there a way to see when a listing was posted?

We believe that, over time, both businesses will have more market and business opportunities with potential partners as independent companies. Both eBay and PayPal will be sharper, stronger, more focused, and competitive as leading, standalone companies in their respective markets. They will have added flexibility to pursue new markets and partnership opportunities.

5. When will the separation occur?

The company expects to complete the transaction as a tax-free spin-off to be completed in the second half of 2015, subject to market, regulatory, and certain other conditions.

6. Will PayPal still be the preferred payment method on the new eBay?

We have no plans at this time to change the experience for buyers and sellers using eBay Marketplaces, which includes offering PayPal as the preferred payment method on eBay.

7. Why is Dan Schulman the right leader to run PayPal?

Dan is a seasoned executive in both financial services and mobile technology, with nearly 30 years of senior leadership experience at global, consumer-centric brands, with an emphasis on both payments and mobile technology. He has a proven track record of leading complex corporate negotiations, transitions, and investor-centric deals.

Here’s How come i can only see when an item was listed for some listings but not others?

Dan has deep knowledge of Payments, Mobile, Finance & Tech. His focus on driving customer adoption of digital payments and mobile technology is ideal for the future of PayPal as it navigates a rapidly-evolving industry landscape and focuses on engaging consumers, partnering with merchants, and innovating in mobile payments.

Since 2010, Dan has served as President of American Express’ Enterprise Growth Group and led the company’s global strategy to expand its alternative mobile and online payment services.

Under his leadership, American Express successfully launched its next-generation digital payments platform, developed non-traditional sources of revenue, and introduced a suite of payment products to expand the company’s demographic and geographic reach.

8. What will John Donahoe and Bob Swan’s roles be between now and separation?

John and Bob will both continue to lead the company as CEO and CFO through the transition until separation. They both have the full support of the Board. As the CEO and CFO of eBay Inc., John and Bob’s primary responsibility to our employees, customers, and shareholders is to ensure the successful transition of eBay and PayPal into two strong, independent companies.

The board, together with John and Bob, have led the review leading to this decision and are in full agreement with it. John and Bob will be responsible for leading the separation process, making all the appropriate decisions that are needed to put each business on a successful path forward. Post-separation, we expect they will serve on one or both of the boards to provide continuity.

9. What will John and Bob be focused on while the companies are being separated?

eBay Inc President and CEO John Donahoe and company CFO Bob Swan will be responsible for leading the separation of each business, with Board oversight.

This includes determining appropriate operating agreements and offering a neutral, but experienced, perspective for decisions affecting both companies long-term. John and Bob will continue to operate as CEO and CFO of the Company until the separation.

10. What is the plan for eBay Enterprise?

We will also be exploring strategic options for eBay Enterprise, including a sale or IPO. Enterprise is a strong business and a leading partner for large retailers, managing mission-critical components of their e-commerce initiatives.

However, it has become clear that it has limited synergies with either business and a separation will allow both to focus exclusively on their core markets, as we create two independent world-class companies.

Related faq’s

Why did eBay and PayPal split

The split between eBay and PayPal in 2015 was driven by a strategic decision to maximize the growth potential of both companies. eBay’s management recognized that while PayPal was crucial for eBay’s marketplace, the two businesses had different growth trajectories and required different strategies to succeed.

PayPal had become a dominant force in digital payments, not just within eBay, but across other platforms and industries. As eBay focused more on its core marketplace business, PayPal needed the flexibility to expand into other areas, such as mobile payments and financial services, without being constrained by eBay’s e-commerce focus.

By separating, both companies gained the independence to pursue their respective opportunities—PayPal to broaden its role in global payments, and eBay to focus on enhancing its marketplace platform. This strategic split allowed each company to better align with their long-term goals and unlock new avenues for growth.

How much did eBay sell PayPal for

ebay, paypal spinoff cost basis

When eBay spun off PayPal in 2015, shareholders of eBay received PayPal shares as part of the transaction. The cost basis for those PayPal shares was determined by the relative value of each company at the time of the split. eBay’s shareholders received one PayPal share for every eBay share they held.

To determine the cost basis of the PayPal shares, shareholders would need to allocate the total cost of their eBay shares between eBay and PayPal based on their respective values at the time of the spinoff.

The IRS provided guidelines for this allocation, based on the fair market value of eBay and PayPal immediately following the spinoff.

For example, if eBay shares were worth $50 and PayPal shares were valued at $30 per share at the time of the spinoff, the cost basis for PayPal shares would be calculated by applying this proportional allocation. Accurate tracking of the spinoff cost basis is important for tax purposes when the PayPal shares are sold.

Who owns eBay

eBay is a publicly traded company, meaning it is owned by shareholders who hold its stock. The largest shareholders typically include institutional investors such as mutual funds, pension funds, and hedge funds. As of recent reports, some of eBay’s largest institutional investors include The Vanguard Group, BlackRock, and Elliott Management Corporation.

These entities collectively own significant portions of eBay’s shares.

In addition to institutional investors, individual investors who purchase eBay stock also own parts of the company. eBay’s stock is listed on the NASDAQ under the ticker symbol “EBAY.”

eBay was founded by Pierre Omidyar in 1995, and he initially held a large stake in the company. However, over time, his ownership decreased as the company went public and additional shares were issued.

Although Omidyar’s influence on the company is much less today, he remains a notable figure in eBay’s history, having shaped its early growth and success.

eBay Investor Relations

eBay’s Investor Relations (IR) provides important financial information and updates for shareholders, analysts, and potential investors.

The IR website is designed to keep stakeholders informed about the company’s performance, strategic initiatives, and overall financial health. Key resources available on eBay’s IR page include quarterly earnings reports, annual financial statements, SEC filings, and press releases regarding corporate developments.

eBay also hosts earnings calls, where executives discuss the company’s financial results, business updates, and future outlook. These calls are often followed by Q&A sessions with analysts. Investors can access information about dividends, stock performance, and investor events.

Through Investor Relations, eBay aims to foster transparency and build trust with the investment community. The IR team also communicates eBay’s strategy, growth initiatives, and responses to market conditions.

This ensures that investors can make informed decisions about their eBay holdings, helping to maintain a strong relationship between the company and its stakeholders.

Conclusion

In conclusion, while eBay Marketplaces was once a crucial driver of PayPal’s growth, it is no longer core to PayPal’s future success.

Since their 2015 split, PayPal has diversified its revenue streams, expanding into mobile payments, fintech, cryptocurrency, and global e-commerce beyond eBay. With strategic partnerships, acquisitions, and a growing presence in online and in-store transactions, PayPal’s growth is now fueled by a much broader ecosystem.

While eBay still contributes some transaction volume, its significance has diminished as PayPal continues to thrive independently. Moving forward, PayPal’s innovation and expansion in the digital payments industry will be its key growth drivers.